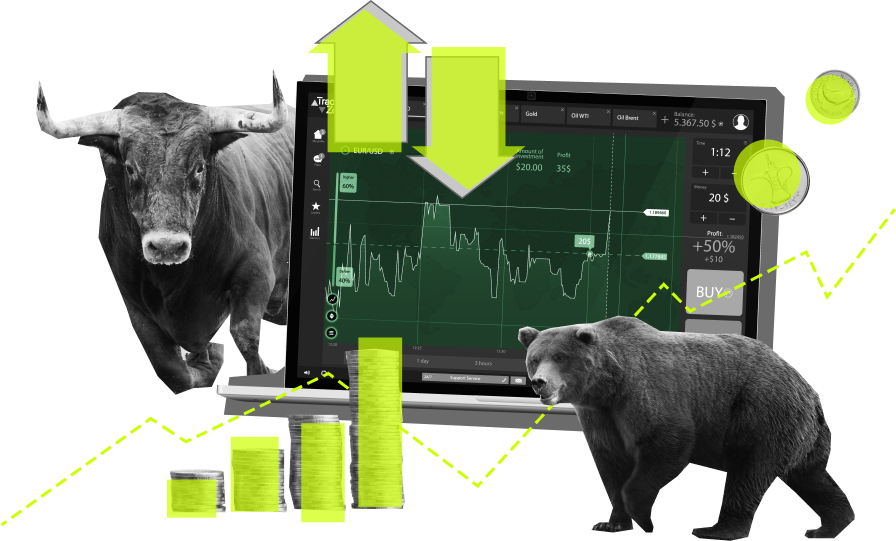

Why is trading not Haram?

Over the past two years, due to the pandemic and the inability to work in the office, there have been more and more opportunities to work online. As Muslims, we have a question about Islam's view of some online services, for example, the possibility of earning additional income through online trading.

Historical view on trading

Let's start by thinking about Islam's relationship to trading. Muslims were not afraid to start trading and earning profits; also, Muhammad himself was a trader. He believed in trading ethically and truthfully. He was convinced that the profit should be spent on helping the poor and the society honestly.

Thus, if you are chasing profits in a particular country during negative events such as earthquakes, man-made disasters, and the misfortune of people, this situation is undoubtedly Haram. If a tsunami has come to Japan, and you begin to open short positions on Sony and Toyota shares, you can deliberately worsen the country's economy. This is Haram; even non-religious people think so. But if you bet on the growth of Tesla shares, then this improves the company's influence in the world as electric vehicles are more environmentally friendly. In this case, you are participating in improving the environment. Even if you trade with СFD or binary options on Tesla, you increase the overall interest of the company, which again is a positive activity and cannot be Haram. And with this, you are involved in raising public interest in what makes our lives and the world a better place. Historical view on trading

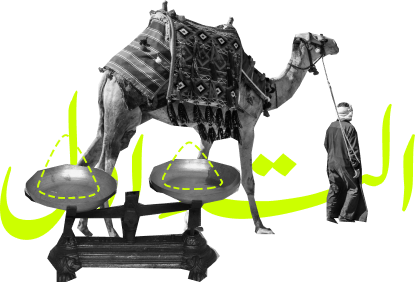

We can also look at the Quran for confirmation that commerce is not a problem. According to the Quranic declaration: 'Allah has permitted trade and forbidden riba [usury].' In this way, it is important to understand that trading is not Haram in Islam as long as it is not done in a fashion that is deemed as gambling and gaining one's interest. In other words, trading is permissible if you are not addicted to trading like gambling and if you apply technical analysis, research the global economy, and practice financial planning. Learning and acquiring new knowledge is not forbidden in Islamic culture, therefore, trading has nothing to do with betting on camel racing, trading is business, education, research, analytics, and science.

Also, do not forget that every devoted Muslim must pay zakat from his income. This is quite important and applies to income from both physical trade and any that is made electronically. This is important for every Muslim and should not be neglected in relation to the income received from trading.

So we found out that there is no direct ban on trading in the Quran, but in some hadiths there is a ban on trading birds in the sky, a calf in the womb of a cow, and so on. How to deal with it? After all, online trading is very similar to trading something that we do not own at the physical level.

Let's take a look at the difference. In this example, the calf has not yet been born and is inside the cow, but the financial asset already exists: real market participants are already there. Roughly speaking, you buy a digital asset when you trade in any market. The growth of Bitcoin or Tesla shares is a real thing, which you have in the form of sent/received kilobytes of information recorded in the trade server logs. And in fact, you own a digital certificate for the right to buy/sell an asset to earn money or to make financial forecasts if we are talking about binary options. But meteorologists also earn an income by making weather forecasts. Can their work be considered as Haram? Or shouldn’t meteorologists earn an income from their work? I think the answer here is obvious: being a meteorologist or hydrologist is not Haram, and a trader is not much different from them.

The same theories and methods are used in meteorology and forecasting financial markets. For example, the well-known theory of Lorenz "The Butterfly Effect" on the levels of physics describes the trajectory of cigarette smoke, how the weather changes, and changes in financial markets. If you are a farmer and you are going to plant vegetables, and then you find out that there will be weather conditions that will destroy the seedlings tomorrow, will you really plant them anyway? Conversely, if the season is predicted with good weather for your vegetables, won't you want to plant them? The same applies to using and writing forecasts in financial markets.

It is Haram to bet in a casino, but making money from scientific forecasts and applying them cannot be Haram. As well as meteorology and binary options trading being in the same earning category here.

How it works in reality

Let's look at the example of fixed-time trading. FTT means you can't lose more than a sum of trade. In this mode, the possible profit and loss are known in advance.At the same time, in most companies, FTT trading is always Swap Free accounts. The very mechanics of FTT trading do not consider the difference between the rates of central banks, which eliminates the need for daily clearing of trading positions. In other words, Swap free trading completely frees you from the sin of riba.

So, a fixed-time trade is a contract that gives the trader the right but not the duty to purchase a particular underlying asset at a specific price and time. As a result, it just grants you the right but not the responsibility. The purchaser can decline to buy the underlying asset and forfeit the down payment.

Actually, FTT trading is more like making a down payment on a car or house with no obligation to purchase it, where a buyer has the option to decline to buy the house and forfeit the down payment. We can agree that such rights and actions are not Haram in everyday life, nor online commerce.

Recommended trading platforms that complies with Muslim religious standards

According to many professional and amateur users, trading platforms from Islamic Brokers Rating creates excellent conditions for all customers to trade comfortably regardless of religion or nationality. In general, the list of functions and several work concepts were somewhat adjusted to conform to Muslim religious standards. These companies offer trading accounts based on Islamic principles because they satisfy the following conditions at least:

- Immediate execution of trades

- Immediate settlement of transactional cost

- No interest payable on trades (all accounts are Swap Free ones)

In the companies from the Islamic Brokers Rating, any resident of an Arab country such as Saudi Arabia, Jordan, Egypt, or any other resident of Islamic countries can register an account and conduct trades without violating Islamic law. This is helpful for individuals who want to earn money online and want to live up to their religious beliefs.

Traders of these companies have access to many indicators, education materials, demo accounts for practicing, and much more. They can also establish regular and VIP accounts in their native language. Also, these companies offer Arabic, Indonesian, and Turkish languages on the trading platform and its support and VIP sales department.

If you still have doubts, you can open a free demo account and start learning trading strategies at any company from the Islamic Broker Rating without any material or religious risks.

Risk Warning: Trading Forex, CFDs, and Binary Options on margin carries a high level of risk and may not be suitable for all investors. CFDs are complex instruments and come with a high risk of losing money. You should consider whether you understand how CFDs/Binary Options work and whether you can afford to take the high risk of losing your money. Before trading, you should consider your level of experience and financial situation.